Commanding a market cap of $261.8 billion, Morgan Stanley (MS) is a leading global financial services firm. Headquartered in New York, the company advises corporations, governments, and individuals on capital markets, mergers and acquisitions, investment strategies, and asset management.

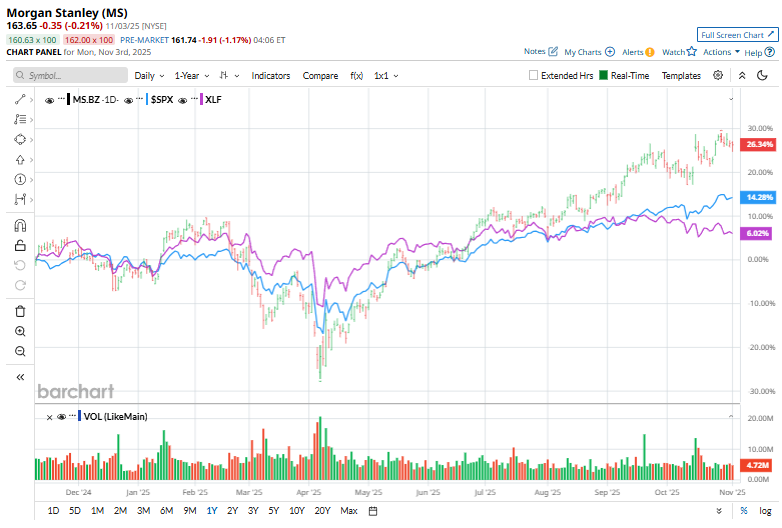

Morgan Stanley has been on a winning streak. Over the past year, the stock has climbed 40.1%, outpacing the broader S&P 500 Index ($SPX), which rose by 19.6%. The stock has carried that strength into 2025 as well, posting a 30.2% increase year-to-date, while the broader index has risen 16.5%.

Performance leadership is also evident within the financial sector, with returns handily exceeding the Financial Select Sector SPDR Fund’s (XLF) 11.8% return over the past year and 7.9% gain this year.

On Oct. 15, Morgan Stanley shares climbed 5% after the firm delivered third-quarter results that topped analyst estimates on both topline and bottom line. Its revenue grew 18% year over year to $18.2 billion, while EPS jumped to $2.80, thanks to a sharp rebound in investment banking activity, highlighted by a roughly 44% surge in deal-making fees, along with strong equities trading performance. The wealth and asset-management franchise also delivered solid growth, supported by total client assets approaching $8.9 trillion, further reinforcing the firm’s broad-based momentum.

For the fiscal year 2025, ending in December, analysts anticipate MS to achieve EPS growth of 18.5%, reaching $9.42 on a diluted basis. Notably, Morgan Stanley has consistently beaten consensus estimates over the past four quarters.

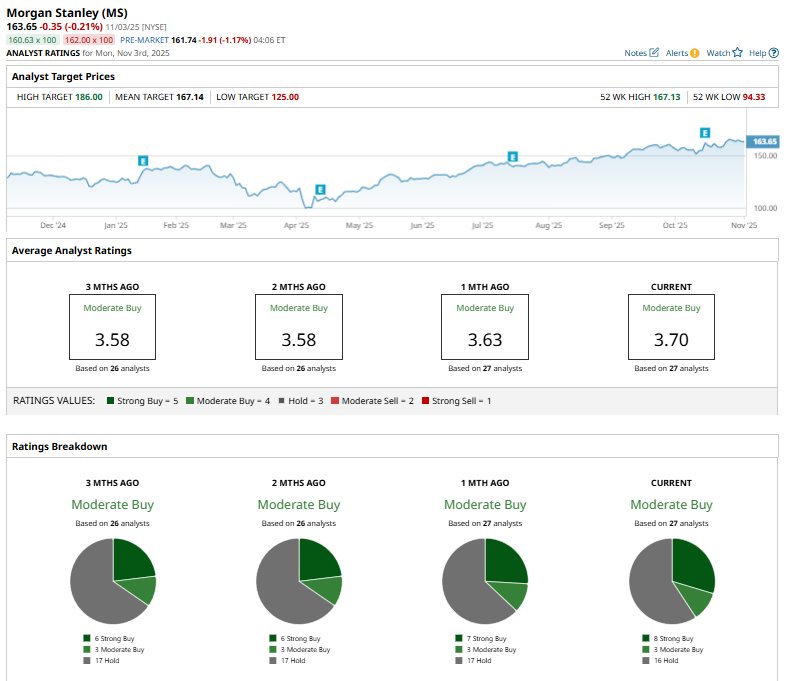

Among 27 analysts covering MS stock, the consensus rating is a "Moderate Buy," comprising eight "Strong Buy" ratings, three "Moderate Buys," and 16 "Holds."

The current analyst sentiment is slightly more bullish than a month ago, when MS had seven "Strong Buy" ratings.

On Oct. 21, JPMorgan analyst Kian Abouhossein reiterated a “Neutral” rating on Morgan Stanley but raised the price target from $122 to $157, signaling a more upbeat outlook on the firm’s valuation despite maintaining a balanced stance.

The mean price target of $167.14 represents a 2.1% premium to MS’ current price levels. Meanwhile, the Street-high price target of $186 suggests a potential upside of 13.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart