Penny stocks are a dime a dozen, but KORE Group Holdings (NYSE: KORE) and Banzai International (NASDAQ: BNZI) stand out. These up-and-coming tech companies provide in-demand services that facilitate, enable, and aid AI applications globally. They are in a position to ride the 2nd wave of AI, the AI service industry wave, and will likely produce substantial, market-beating growth over the next five years, if not hyper-growth.

With shares trading for pennies on the dollar, now is the time to get some exposure and start building positions.

KORE Group Holdings: Ahead of Its Time

[content-module:CompanyOverview|NYSE:KORE]KORE Group Holdings is a company ahead of its time and in a position to grow along with the IoT industry. The IoT industry is forecasted to grow at a high teens CAGR over the next five to ten years, with the number of connected devices doubling by 2030 and then again before the end of the next decade, a dual tailwind for this business. Connected device growth is tied to the rise of 5G, improving network coverage, and the ability to run advanced applications, including AI-assisted applications.

KORE Group Holdings is an IoT services and solutions provider serving industries such as healthcare, fleet management, asset management, communications, and industrial production. Its operations span the globe and will cover more than 19 million connected devices in 2025.

Highlights from fiscal 2024 include a reversion to top-line growth and improving operational quality. The company is cash-flow negative, but losses are dwindling due to the now-completed restructuring efforts and improving client metrics.

The forecast for F2025 is for incremental top-line growth, followed by acceleration in 2026 and 2027. It is likely a lowball estimate due to the low number of analysts covering the stock and the lack of recent changes.

Analysts have left KORE Group for dead, but institutions have not.

While analysts' coverage dwindled to a single report, the institutions have held the stock, which is a significant position. MarketBeat indicates a 50% institutional ratio with names like State Street Corp listed among the largest shareholders.

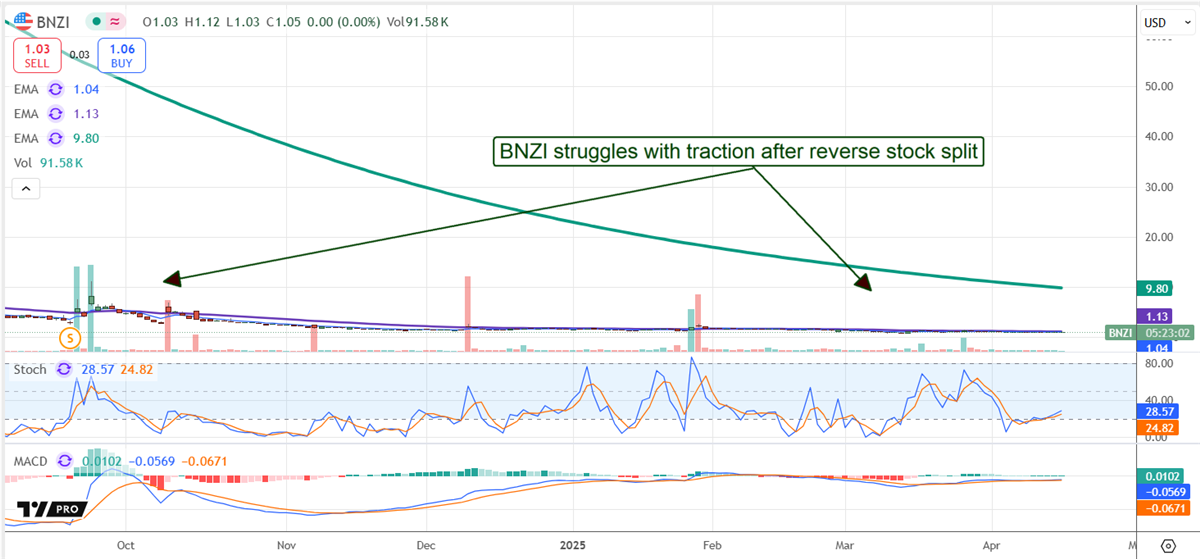

Banzai International is Ripe for a Takeover

[content-module:CompanyOverview|NASDAQ:BNZI]Banzai International is well-positioned in its industry to provide CEP-related services and is also a ripe takeover target. CRM companies like Salesforce (NYSE: CRM) or those who want to boost AI-assisted CRM and CEP services like Microsoft will find their web-based offerings appealing.

Banzai has already partnered with Salesforce to boost webinar campaigns, so Salesforce is the obvious buyer. The company offers three primary services: a browser-based webinar platform, social-sharing tools, and AI-powered services to boost registration and attendance at live events.

The Demio platform is the primary business. It allows companies, institutions, and organizations to host live and on-demand events and market their products to consumers using data-driven insights. The company’s revenue has been steady for the first few quarters since the IPO, but highlights from within the reports reveal rapidly increasing momentum.

The company is quickly improving its client counts, net retention rates, and annual recurring revenue and launching new products to drive growth in the coming quarters. The consensus for F2025 is for revenue to grow by nearly 90%.

Analysts and institutional activity are light for this stock but bullish overall. The data tracked by MarketBeat reveals a single analyst rating the stock as Buy with a price target forecasting a 1000% upside, while institutions, hedge funds, and private equity own nearly 100% of the shares.

With this in play, the market is set up for a substantial upswing and needs only a catalyst to drive it. That could come with the FQ4 earnings release and guidance for 2025.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...