As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the productivity software industry, including Box (NYSE:BOX) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 20.4% since the latest earnings results.

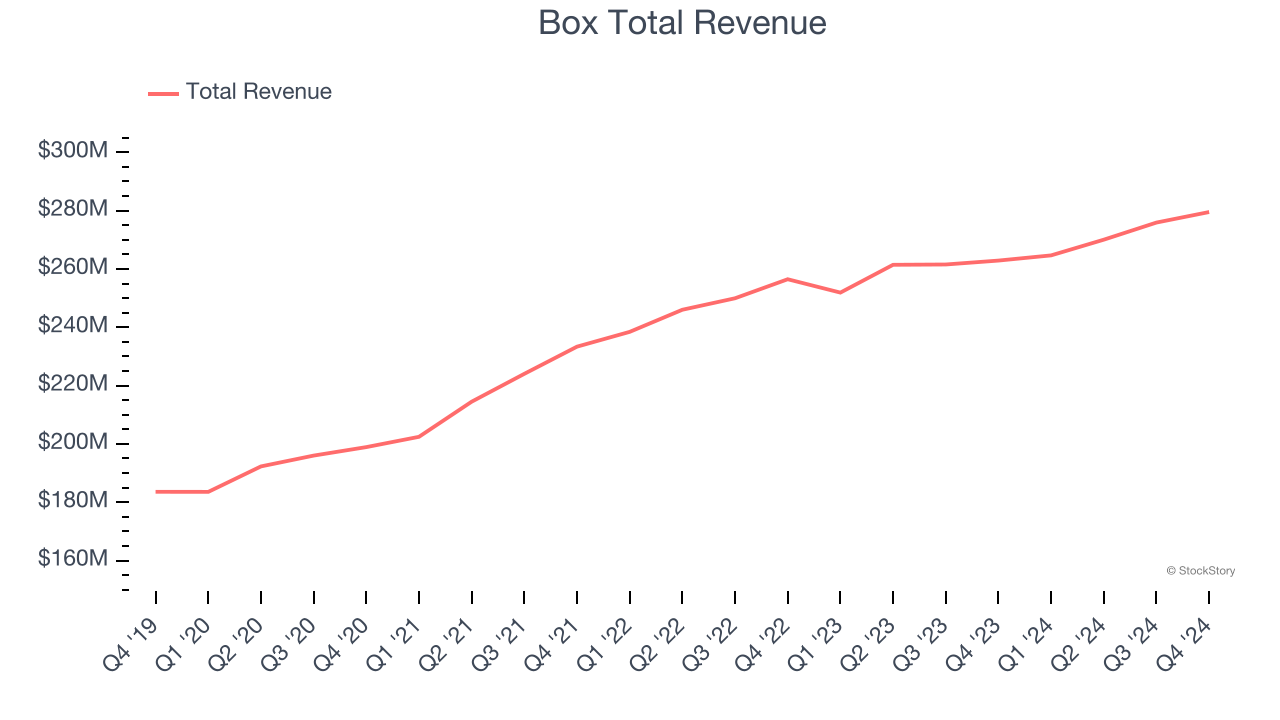

Weakest Q4: Box (NYSE:BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE:BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $279.5 million, up 6.3% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with full-year EPS guidance missing analysts’ expectations.

The stock is down 11.5% since reporting and currently trades at $29.65.

Read our full report on Box here, it’s free.

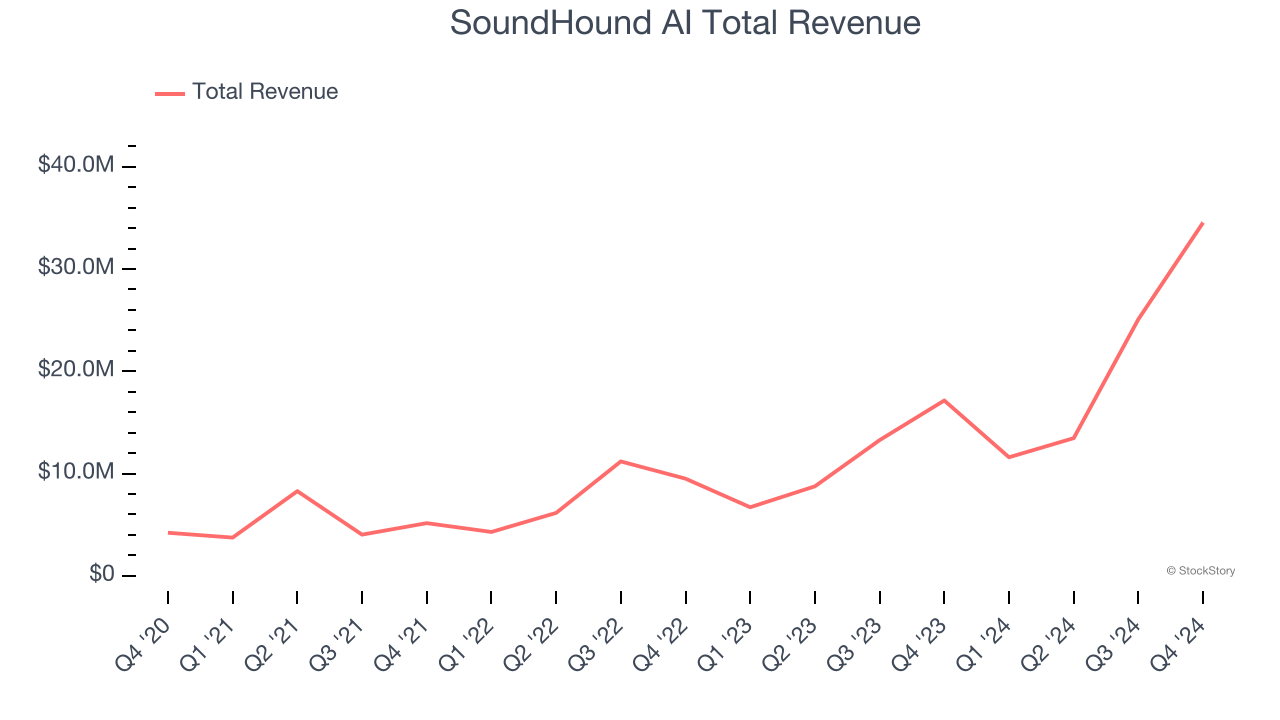

Best Q4: SoundHound AI (NASDAQ:SOUN)

Founded in 2005, SoundHound AI (NASDAQ:SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $34.54 million, up 101% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

SoundHound AI delivered the fastest revenue growth among its peers. The stock is down 15% since reporting. It currently trades at $7.83.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

RingCentral (NYSE:RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $614.5 million, up 7.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted EPS guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 26% since the results and currently trades at $22.77.

Read our full analysis of RingCentral’s results here.

Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software-as-a-service that makes it easier for companies to set up and efficiently run call centers to offer more tailored customer support.

Five9 reported revenues of $278.7 million, up 16.6% year on year. This number topped analysts’ expectations by 4%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

The stock is down 46.3% since reporting and currently trades at $22.47.

Read our full, actionable report on Five9 here, it’s free.

DocuSign (NASDAQ:DOCU)

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

DocuSign reported revenues of $776.3 million, up 9% year on year. This result beat analysts’ expectations by 1.9%. Zooming out, it was a satisfactory quarter as it also logged a solid beat of analysts’ billings estimates.

The stock is flat since reporting and currently trades at $75.42.

Read our full, actionable report on DocuSign here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.