What a fantastic six months it’s been for Proto Labs. Shares of the company have skyrocketed 62.4%, setting a new 52-week high of $45.77. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Proto Labs, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We’re happy investors have made money, but we don't have much confidence in Proto Labs. Here are three reasons why you should be careful with PRLB and a stock we'd rather own.

Why Do We Think Proto Labs Will Underperform?

Pioneering the concept of online quoting and manufacturing for custom prototypes and low-volume production parts, Proto Labs (NYSE:PRLB) offers injection molding, 3D printing, and sheet metal fabrication for manufacturers in various industries.

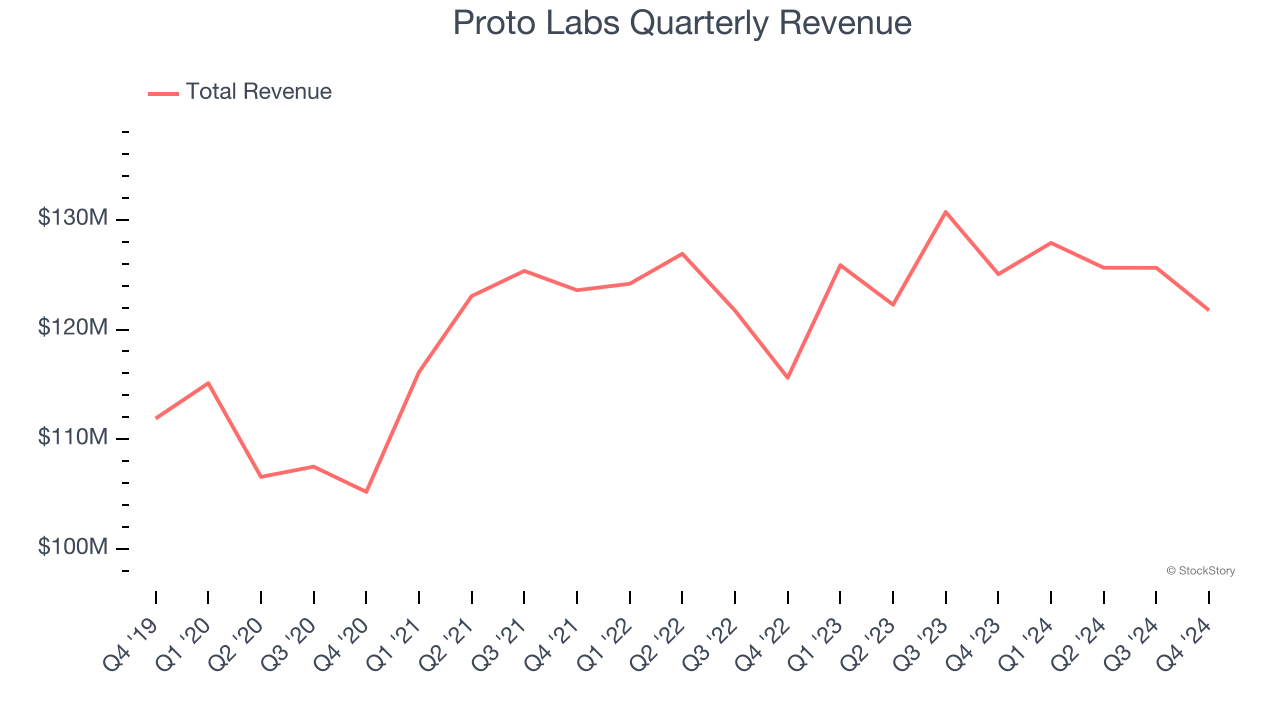

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Proto Labs’s sales grew at a sluggish 1.8% compounded annual growth rate over the last five years. This was below our standards.

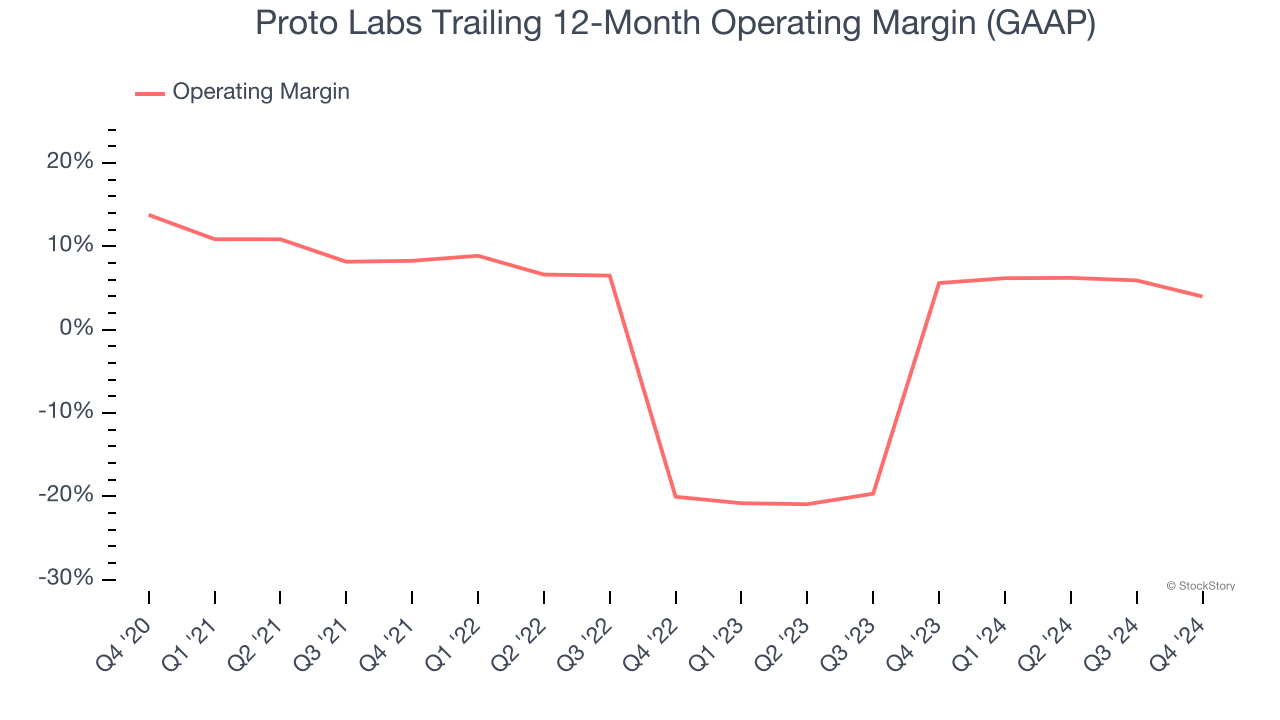

2. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Proto Labs’s operating margin decreased by 9.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Proto Labs’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 4%.

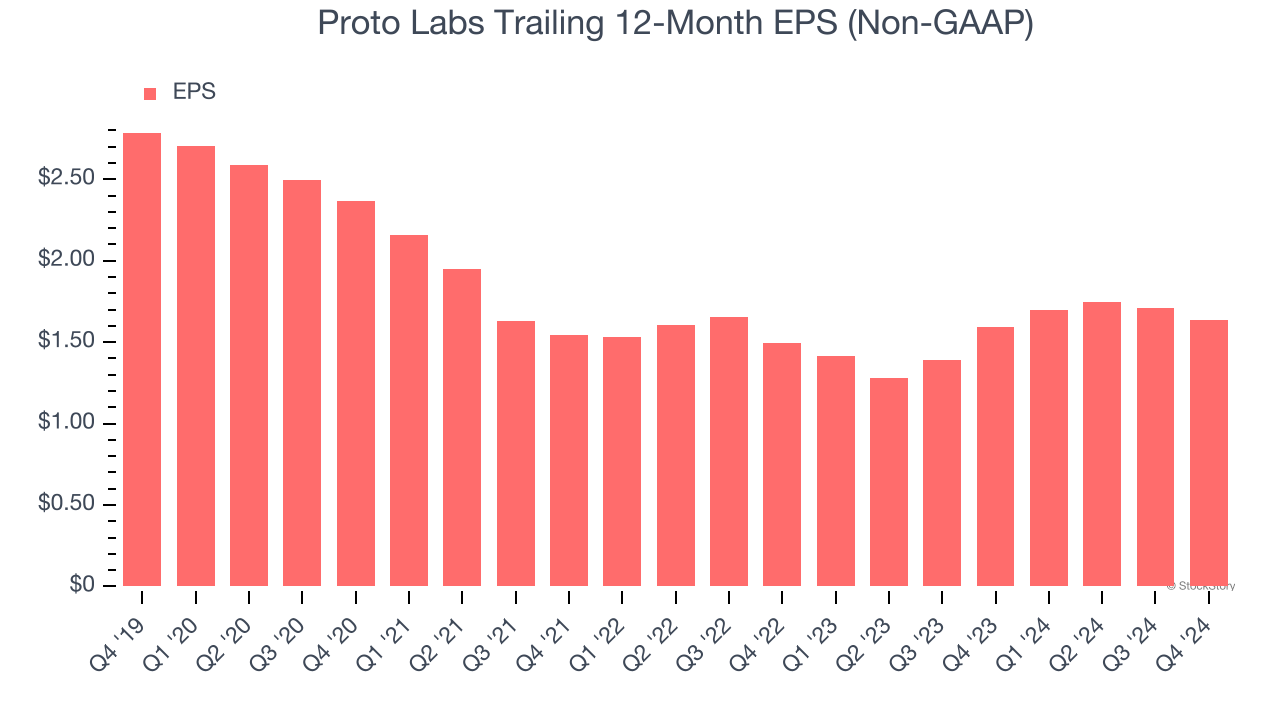

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Proto Labs, its EPS declined by 10.1% annually over the last five years while its revenue grew by 1.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Proto Labs, we’ll be cheering from the sidelines. Following the recent rally, the stock trades at 21.2× forward price-to-earnings (or $45.77 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Proto Labs

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.