Celsius currently trades at $42.58 and has been a dream stock for shareholders. It’s returned 1,249% since June 2020, blowing past the S&P 500’s 88% gain. The company has also beaten the index over the past six months as its stock price is up 39.1%.

Following the strength, is CELH a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does CELH Stock Spark Debate?

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Two Positive Attributes:

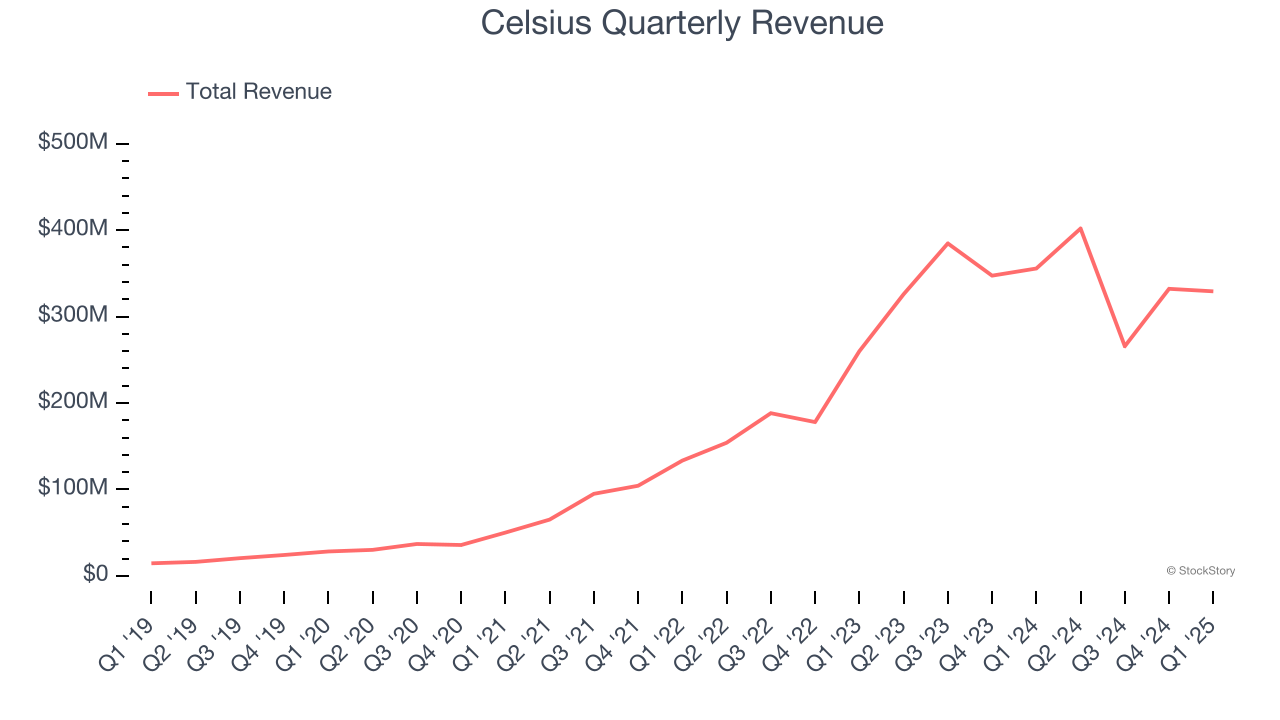

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Celsius’s 49.5% annualized revenue growth over the last three years was incredible. Its growth surpassed the average consumer staples company and shows its offerings resonate with customers.

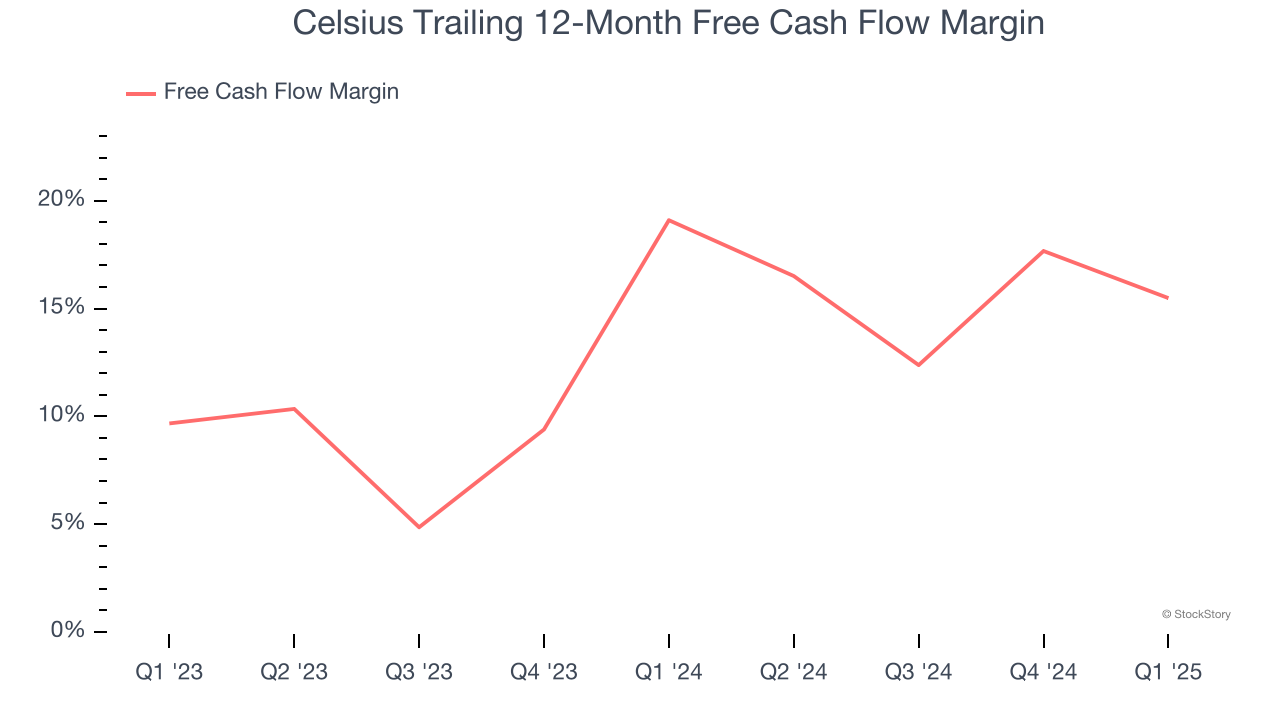

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Celsius has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 17.3% over the last two years.

One Reason to be Careful:

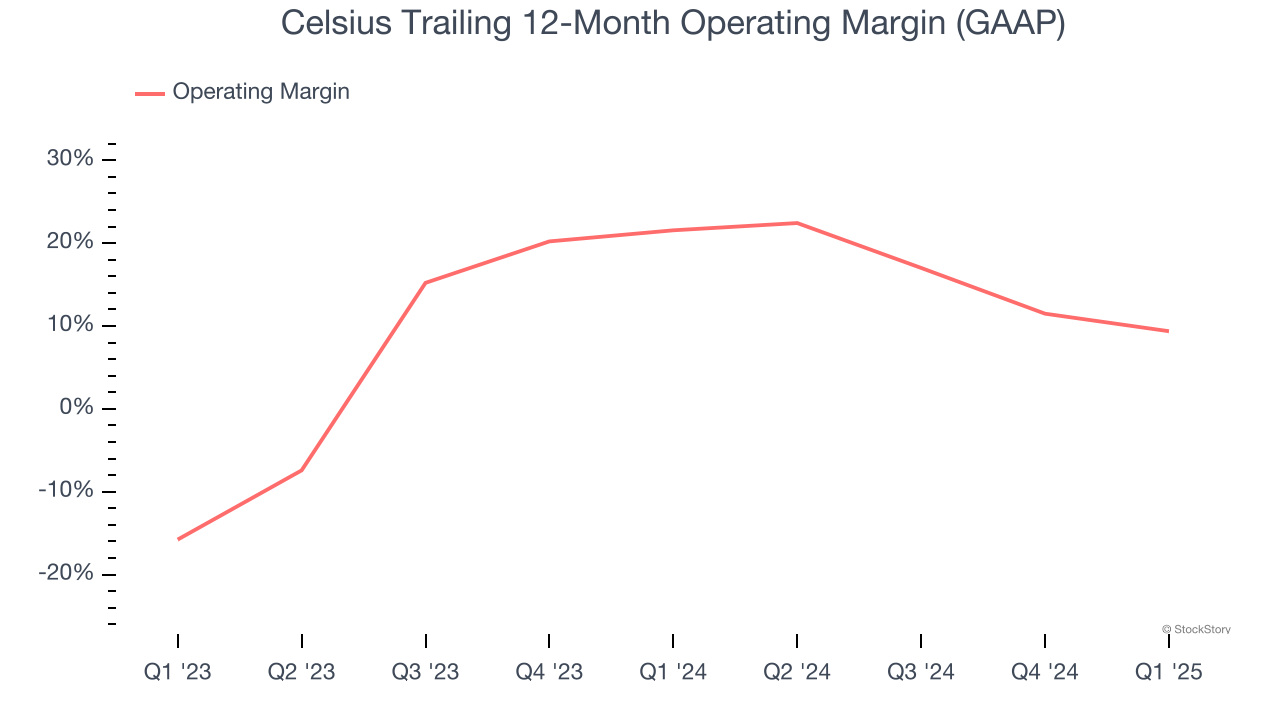

Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Celsius’s operating margin decreased by 12.2 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 9.4%.

Final Judgment

Celsius has huge potential even though it has some open questions, and with its shares topping the market in recent months, the stock trades at 39.9× forward P/E (or $42.58 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Celsius

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.