Cloud computing and online retail behemoth Amazon (NASDAQ:AMZN) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 13.3% year on year to $167.7 billion. Guidance for next quarter’s revenue was optimistic at $176.8 billion at the midpoint, 2.1% above analysts’ estimates. Its GAAP profit of $1.68 per share was 26% above analysts’ consensus estimates.

Is now the time to buy Amazon? Find out by accessing our full research report, it’s free.

Amazon (AMZN) Q2 CY2025 Highlights:

- Revenue: $167.7 billion vs analyst estimates of $162.2 billion (3.4% beat)

- Operating Profit (GAAP): $19.17 billion vs analyst estimates of $17 billion (12.8% beat)

- EPS (GAAP): $1.68 vs analyst estimates of $1.33 (26% beat)

- Q3 operating profit guidance of $18.0 billion at the midpoint vs analyst estimates of $19.5 billion (7.7% miss)

- North America Revenue: $100.1 billion vs analyst estimates of $97.1 billion (3.1% beat)

- AWS Revenue: $30.87 billion vs analyst estimates of $30.76 billion (small beat)

- North America Operating Profit: $7.52 billion vs analyst estimates of $5.81 billion (29.4% beat)

- AWS Operating Profit: $10.16 billion vs analyst estimates of $10.88 billion (6.6% miss)

- Operating Margin: 11.4%, up from 9.9% in the same quarter last year

- Free Cash Flow Margin: 0.2%, down from 6% in the same quarter last year

- Market Capitalization: $2.44 trillion

Revenue Growth

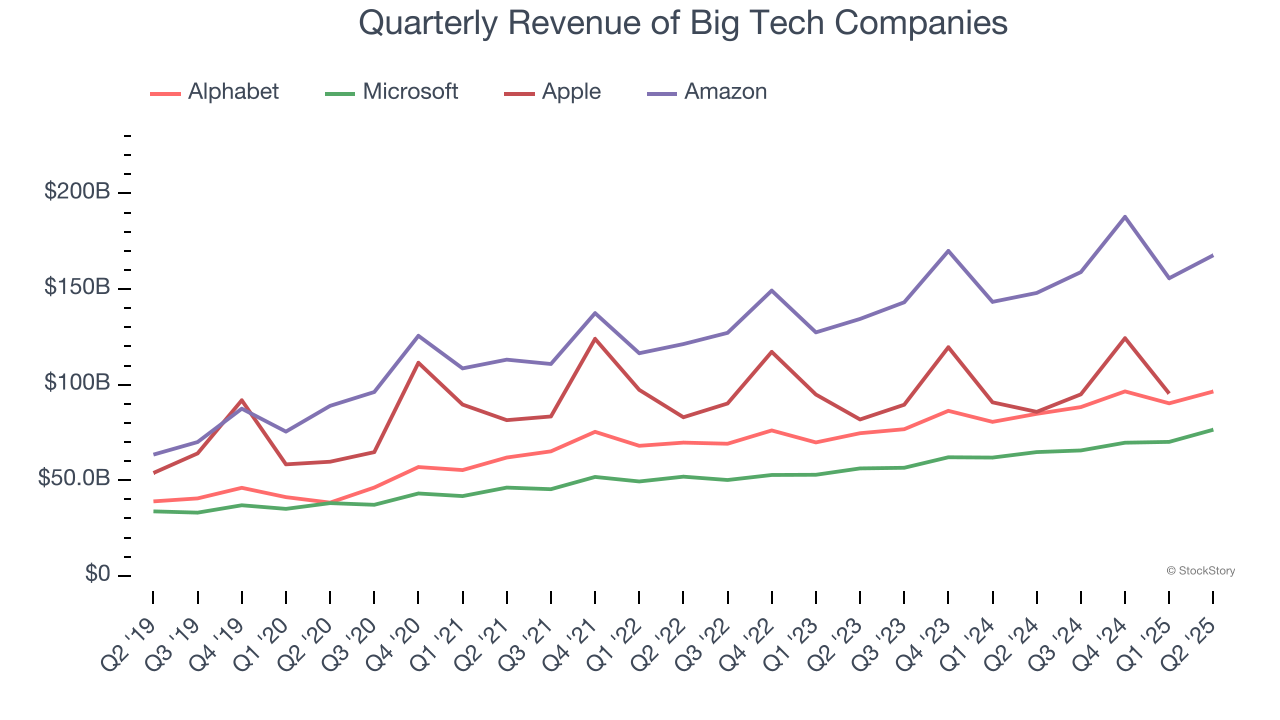

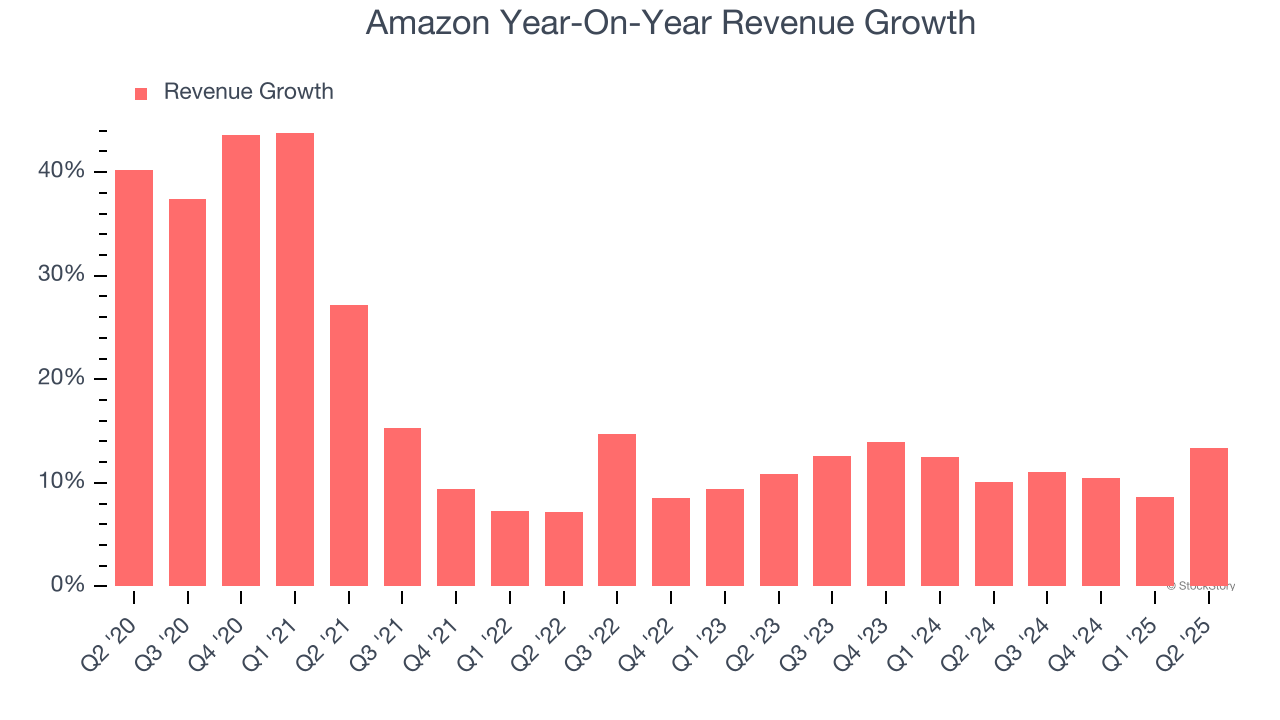

Amazon proves that huge, scaled companies can still grow quickly. The company’s revenue base of $321.8 billion five years ago has doubled to $670 billion in the last year, translating into an incredible 15.8% annualized growth rate.

Over the same period, Amazon’s big tech peers Alphabet, Microsoft, and Apple put up annualized growth rates of 17.5%, 14.5%, and 8%, respectively. Comparing the four is relevant because investors often pit them against each other to derive their valuations.

Long-term growth reigns supreme in fundamentals, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Amazon’s annualized revenue growth of 11.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Amazon reported year-on-year revenue growth of 13.3%, and its $167.7 billion of revenue exceeded Wall Street’s estimates by 3.4%. Company management is currently guiding for a 11.2% year-on-year increase in sales next quarter. Looking further ahead, sell-side This projection is still healthy and illustrates the market sees some success for its newer products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Profitability: The Key Debate

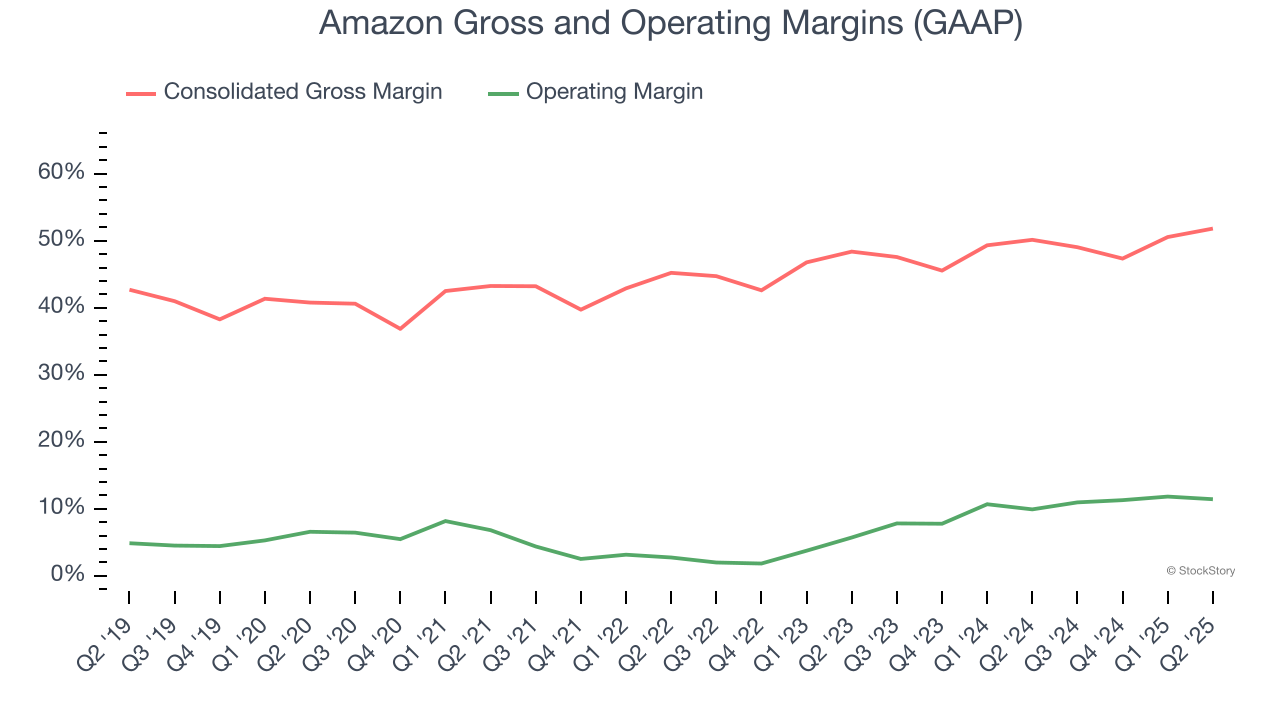

Many investors understand that Amazon’s e-commerce business caps its gross margin, which averaged 45.8% over the last five years. The company lags behind its pure-play tech peers because it sells many commoditized goods online where it must acquire and hold physical inventory.

What the market debates, however, is where Amazon’s long-term operating profitability could ultimately settle. Sure, its five-year margin of 7% was weak, but it rose by 4.7 percentage points thanks to leverage on the fixed costs in its consumer-facing businesses and the highly profitable AWS segment becoming a larger portion of its revenue. Our question is if Amazon’s momentum can continue and result in a mid-to-high teen percentage margin somewhere down the line.

The company’s North America segment holds the keys to this answer. Throughout the years, Amazon has made huge investments to not only attract hoards of customers into its ecosystem but also retain them. Some areas of focus in this effort included its unmatched delivery network and video streaming content.

Bulls will argue that Amazon can afford to ease up and begin riding its investments of the last two-plus decades. Wall Street seems to disagree somewhat and is projecting its trailing 12-month operating margin of 11.4% to stagnate in the coming year.

Key Takeaways from Amazon’s Q2 Results

We liked seeing Amazon beat analysts’ revenue expectations this quarter, although the all-important AWS segment beat by a smaller amount. We were also excited its operating income outperformed Wall Street’s estimates by a wide margin, although AWS profit missed. Adding to the bad news was the fact that Amazon's operating income guidance for next quarter missed. The company also cited tariff and trade policies as a factor impacting guidance and future results, adding more uncertainty to the near-term story. The market seemed to be hoping for more, and the stock traded down 3.8% to $225.13 immediately after reporting.

Is Amazon an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.