Chevron Corp (CVX)

183.93

-0.85 (-0.46%)

NYSE · Last Trade: Feb 22nd, 1:39 AM EST

This ETF is getting an oil-fueled boost.

Via The Motley Fool · February 21, 2026

If you're seeking income growth and diversification through the energy sector, Chevron is a top stock to consider today.

Via The Motley Fool · February 21, 2026

Chevron is a top-tier dividend stock.

Via The Motley Fool · February 21, 2026

In a dramatic display of market bifurcation, U.S. equity sectors have split into two distinct camps today, February 20, 2026. The high-octane growth of the Technology sector and the resurgent dominance of Energy are currently spearheading a market rally, even as the "bond proxy" sectors—Utilities and Real Estate—

Via MarketMinute · February 20, 2026

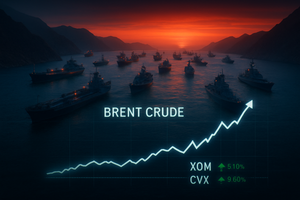

Crude oil prices surged past the critical $66 per barrel threshold on Friday, February 20, 2026, as geopolitical stability in the Middle East teetered on the brink. West Texas Intermediate (WTI) crude climbed to $66.40, marking a six-month high, while Brent crude crossed the $71.99 mark. The rally

Via MarketMinute · February 20, 2026

HOUSTON, TX — In a definitive shift that marks the end of an era of aggressive expansion, Occidental Petroleum (NYSE: OXY) has unveiled a 2026 capital allocation strategy that prioritizes "Value over Volume." Following a transformational start to the year, the Houston-based energy giant is signaling to the market that its

Via MarketMinute · February 20, 2026

Energy markets are on high alert this morning as crude oil prices climbed to a six-month high, nearing $67 per barrel. The surge follows a series of aggressive maneuvers in the Persian Gulf and inflammatory rhetoric from both Washington and Tehran, reigniting fears of a direct military confrontation that could

Via MarketMinute · February 20, 2026

On February 2, 2026, the American energy landscape shifted significantly as Devon Energy (NYSE: DVN) announced a definitive agreement to acquire Coterra Energy (NYSE: CTRA) in an all-stock transaction valued at approximately $21.4 billion. The deal, which creates a combined entity with an enterprise value of roughly $58 billion,

Via MarketMinute · February 20, 2026

As of February 20, 2026, global energy markets are reeling from a sharp escalation in geopolitical hostilities between Washington and Tehran. Following the collapse of high-level nuclear negotiations in Geneva, President Donald Trump has issued a stern 15-day ultimatum to the Iranian government, demanding a comprehensive agreement that curtails not

Via MarketMinute · February 20, 2026

Industrials, energy, and materials stocks are outperforming the market this year.

Via The Motley Fool · February 20, 2026

As of February 20, 2026, the offshore drilling industry is witnessing a tectonic shift, and at its epicenter stands Transocean Ltd. (NYSE: RIG). After a decade defined by brutal restructuring and a fight for survival following the 2014 oil collapse, Transocean has re-emerged not just as a survivor, but as a consolidator. The company’s recent [...]

Via Finterra · February 20, 2026

As of February 20, 2026, Saudi Aramco (TADAWUL:2222) has transcended its role as the world’s largest oil producer to become the ultimate engine of national economic transformation. With a market valuation stabilizing at a staggering $1.66 trillion, the state-owned titan has embarked on an unprecedented series of

Via MarketMinute · February 20, 2026

The World Bank’s latest Commodity Markets Outlook, updated as of February 2026, forecasts that global commodity prices will plunge to their lowest levels in six years. Driven by a massive projected oil surplus and cooling industrial demand from China, the aggregate index of commodity prices is expected to fall

Via MarketMinute · February 20, 2026

Energy markets were sent into a frenzy on February 20, 2026, as West Texas Intermediate (WTI) crude oil surged to $66.5 per barrel, marking a six-month peak. The price spike follows a "perfect storm" of geopolitical brinkmanship and tightening domestic supply, leaving investors bracing for a volatile spring. The

Via MarketMinute · February 20, 2026

Today, Feb. 19, 2026, Walmart’s cautious outlook rattled U.S. stocks as investors weighed fading rate-cut hopes and rising geopolitical risk.

Via The Motley Fool · February 19, 2026

In a dramatic show of market strength, shares of Occidental Petroleum (NYSE:OXY) surged 9.4% today, February 19, 2026, following a fourth-quarter earnings report that handily outpaced Wall Street expectations. The Houston-based energy giant reported adjusted earnings of $0.31 per share, nearly double the consensus analyst estimate of

Via MarketMinute · February 19, 2026

HOUSTON, TX — Global energy markets are bracing for a period of extreme volatility as crude oil prices surged past $95 per barrel this week, fueled by a dramatic escalation in geopolitical tensions between Western powers and Iran. The threat of a military conflict in the Persian Gulf has moved from

Via MarketMinute · February 19, 2026

The landscape of American energy shifted significantly this week as Devon Energy (NYSE: DVN) officially finalized its blockbuster $21.4 billion merger with Coterra Energy (NYSE: CTRA). The closing of the deal, which marks the largest independent oil and gas transaction of early 2026, creates a diversified "mega-independent" operator with

Via MarketMinute · February 19, 2026

As of February 19, 2026, the U.S. energy sector has emerged as the clear leader in the global financial markets, staging a massive rally that has caught many institutional investors off guard. Driven by a volatile mix of escalating military tensions in the Middle East and a sudden tightening

Via MarketMinute · February 19, 2026

Global financial markets were jolted on Thursday, February 19, 2026, as escalating tensions between Washington and Tehran reached a critical flashpoint. Crude oil prices jumped 2% during midday trading following reports that the United States is actively considering military strikes against Iranian nuclear infrastructure and strategic assets. The move comes

Via MarketMinute · February 19, 2026

Chevron Corporation (CVX) shares touched a new 52-week high of $187.90 on Thursday, bucking broader market weakness as the energy sector outperformed.

Via Benzinga · February 19, 2026

The energy landscape in early 2026 is defined by a singular, insatiable demand: reliable, scalable power for the artificial intelligence revolution. At the heart of this infrastructure super-cycle sits Targa Resources Corp. (NYSE: TRGP), a Houston-based midstream powerhouse that has transitioned from a steady utility-like operator into an aggressive growth engine. As of February 19, [...]

Via Finterra · February 19, 2026

The global energy market is on a knife-edge this week as geopolitical tensions between the United States and Iran reached a fever pitch, sending crude oil prices to their highest levels in months. As of February 19, 2026, Brent crude has breached the $71 per barrel mark, while West Texas

Via MarketMinute · February 19, 2026

The global commodities market is standing at a historic crossroads as we move further into 2026. According to the latest World Bank Commodity Markets Outlook, aggregate commodity prices are projected to plunge to their lowest levels since 2020 by the end of this year. This downward trajectory, characterized by a

Via MarketMinute · February 19, 2026

The energy markets are on edge this week as West Texas Intermediate (WTI) crude oil futures surged toward $66 per barrel, marking their highest level since August 2025. This rapid price appreciation comes as a "perfect storm" of geopolitical instability and tightening domestic supplies caught traders off guard, reversing a

Via MarketMinute · February 19, 2026