Fidelity National Information Services (FIS)

49.14

-1.41 (-2.80%)

NYSE · Last Trade: Feb 11th, 11:07 AM EST

Detailed Quote

| Previous Close | 50.55 |

|---|---|

| Open | 50.50 |

| Bid | 49.12 |

| Ask | 49.15 |

| Day's Range | 49.11 - 50.50 |

| 52 Week Range | 50.07 - 83.71 |

| Volume | 832,925 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 1.600 (3.26%) |

| 1 Month Average Volume | 5,176,631 |

Chart

About Fidelity National Information Services (FIS)

Fidelity National Information Services is a leading global provider of technology solutions for financial institutions, businesses, and government agencies. The company offers a wide array of services, including payment processing, banking software, and transaction management, enabling clients to enhance their operations and improve customer experiences. FIS aims to drive innovation in the financial sector by delivering advanced technology solutions that facilitate seamless transactions, streamline operations, and ensure regulatory compliance. With a strong focus on enhancing digital transformation, FIS plays a crucial role in the evolving landscape of finance and technology. Read More

News & Press Releases

Date: February 11, 2026 Introduction Robinhood Markets, Inc. (NASDAQ: HOOD) has long been the primary antagonist in the narrative of modern retail finance—a disruptor that some blamed for "gamifying" the markets and others praised for democratizing them. However, following its blockbuster Q4 2025 earnings report released late yesterday, the company has officially shed its reputation [...]

Via Finterra · February 11, 2026

Today, February 11, 2026, the equity markets witnessed a defining moment in the artificial intelligence (AI) infrastructure cycle as Vertiv Holdings Co. (NYSE: VRT) released its fourth-quarter and full-year 2025 financial results. Long positioned as the "plumbing" of the digital age, Vertiv has transitioned into the premier architect of the AI era. With a staggering [...]

Via Finterra · February 11, 2026

Fidelity and Vanguard both offer relatively limited rosters of dividend exchange-traded funds (ETFs). Both are winners for different reasons, but each of their dividend ETFs has some flaws.

Via The Motley Fool · February 11, 2026

Stocks moved lower in recent days.

Via Stocktwits · February 11, 2026

Investor focus shifted to Wednesday’s U.S. jobs report, wage data, Fed remarks, and the federal budget release.

Via Stocktwits · February 10, 2026

Weighing cost, scale, and portfolio focus, these ETFs take distinctly different approaches to investment-grade bond exposure.

Via The Motley Fool · February 10, 2026

The iShares 5–10 Year Investment Grade Corporate Bond ETF and the Fidelity Investment Grade Bond ETF both target high-quality corporate bonds, but they rely on very different approaches to deliver stability. This ETF comparison breaks down where that reliability actually comes from and why it matters.

Via The Motley Fool · February 9, 2026

How does your 401(k) compare to the typical Boomer's?

Via The Motley Fool · February 9, 2026

FIS® (NYSE: FIS), a global leader in financial services technology, will announce fourth quarter 2025 financial results on Tuesday, February 24th, prior to market open.

By Fidelity National Information Services · Via Business Wire · February 9, 2026

As the digital asset market navigates a period of early-year volatility, analysts at Bernstein have sent a clear message to institutional investors: stay the course. In a comprehensive research note released this week, the firm reaffirmed its high-conviction price target of $150,000 for Bitcoin by the end of 2026.

Via MarketMinute · February 9, 2026

Compare how portfolio breadth, risk, and sector exposure set these two consumer staples ETFs apart for defensive investors.

Via The Motley Fool · February 9, 2026

The digital asset landscape witnessed a seismic shift this week as Bullish (NYSE: BLSH), the institutional-grade crypto exchange, reported an explosive 70% year-over-year revenue growth in its latest quarterly earnings. Propelled by the meteoric rise of its newly launched options trading platform and a calculated expansion into the United States,

Via MarketMinute · February 9, 2026

As of February 9, 2026, Robinhood Markets (NASDAQ: HOOD) finds itself at a pivotal crossroads. Once the poster child for the "meme-stock" mania of 2021, the Menlo Park-based fintech has undergone a radical transformation into a diversified financial "super-app." Today, the company is in sharp focus as Wall Street analysts issue a wave of upgrades [...]

Via Finterra · February 9, 2026

Are you stunting your savings' growth without even realizing it?

Via The Motley Fool · February 9, 2026

Insurance companies serve as the backbone of risk management, providing essential protection and financial security for individuals and businesses. But worries about an economic slowdown and potential claims deterioration have kept sentiment in check,

and over the past six months, the industry’s 4.8% return has trailed the S&P 500 by 1.8 percentage points.

Via StockStory · February 8, 2026

Explore how these two consumer staples ETFs differ in cost, structure, and risk — key factors for building a resilient portfolio.

Via The Motley Fool · February 8, 2026

Shares of the quantum computing start-up have given back their 2026 gains. Buy the dip?

Via The Motley Fool · February 8, 2026

Expense ratios, risk, and bond mix set these ETFs apart—explore how their distinct profiles could shape your fixed income approach.

Via The Motley Fool · February 8, 2026

Fee structure, asset mix, and liquidity set these crypto ETFs apart—see how each approach shapes investor experience and risk.

Via The Motley Fool · February 8, 2026

A $5,000 investment must grow by 200-fold to reach $1 million.

Via The Motley Fool · February 8, 2026

Bitcoin’s zero-price risk fades as limited supply and growing institutional ownership tighten the market and support long-term demand.

Via Stocktwits · February 8, 2026

Some investors don't want to purchase cryptocurrencies directly, so these two ETFs provide indirect exposure to the digital tokens.

Via The Motley Fool · February 7, 2026

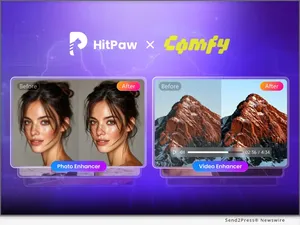

SAN FRANCISCO, Calif., Feb. 7, 2026 (SEND2PRESS NEWSWIRE) -- HitPaw, a leader in AI-powered visual enhancement solutions, announced Comfy, a global content creation platform, is integrating its image and video enhancement API. The HitPaw and Comfy integration embeds HitPaw API into Comfy's workflow, letting creators achieve pro-level visual enhancement in-platform. Blending HitPaw's AI visual processing expertise with Comfy's creator ecosystem, the partnership streamlines workflows and meets rising demand for high-quality digital visuals across digital platforms.

Via Send2Press · February 7, 2026

Rigetti Computing investors have received some bad news in the past few weeks.

Via The Motley Fool · February 7, 2026

BitMine won’t liquidate after ETH’s 40% drop in 10 days, with Tom Lee saying the firm has no leverage or debt despite the selloff.

Via Stocktwits · February 7, 2026